Why Is NVDA Stock in the Spotlight?

The nvda stock is once again capturing headlines, and this time, for positive reasons. Last week, Nvidia (NVDA) reached a $4 trillion market capitalization, surpassing both Microsoft (MSFT) and Apple (AAPL). For many investors, this rally in the nvidia stock has been nothing short of historic.

What makes this achievement even more remarkable is that Nvidia managed this growth despite losing billions in quarterly revenue from China. The losses are tied to strict U.S. export restrictions on advanced AI chips, limiting Nvidia’s business in the Chinese market.

Why Does Jensen Huang’s China Visit Matter for NVDA Stock?

Nvidia CEO Jensen Huang is scheduled to visit China, with a media briefing planned for Wednesday, July 16. This will be his second trip to China in 2025. Ahead of this visit, Huang met with former President Donald Trump. Meanwhile, U.S. senators have sent a bipartisan letter urging Huang not to meet with Chinese companies tied to the military or those listed on the Entity List.

For investors tracking the china nvda stock situation, Huang’s trip is crucial. During Nvidia’s Q1 2026 earnings call, CFO Colette Kress stated that losing access to the China AI accelerator market—estimated to reach $50 billion—could significantly hurt Nvidia’s growth, while benefiting competitors both in China and globally.

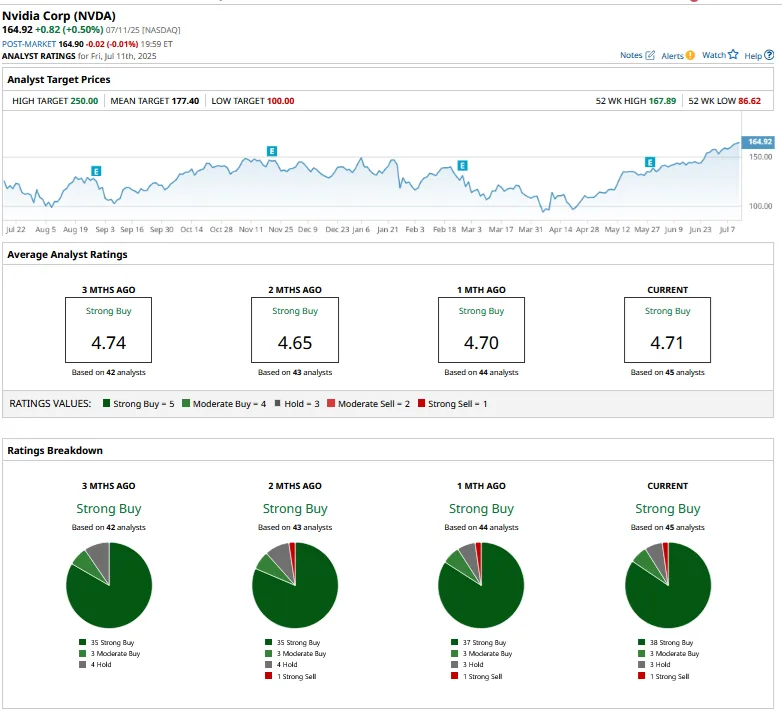

How High Can the NVDA Stock Price Go?

Despite the challenges, Wall Street remains bullish on the nvidia stock. Analysts project a 53.2% year-over-year revenue increase for the current fiscal year, and another 25.7% growth the following year. This growth rate outpaces most of the Magnificent 7 tech giants.

If Nvidia successfully resumes its business in China, the nvda stock price could surge beyond current expectations. Some analysts suggest that a $200 NVDA stock price target is realistic, especially if Nvidia secures export concessions for AI chips to China.

Is Nvidia Stock Overvalued?

At present, the nvda stock trades at a forward price-to-earnings (P/E) ratio of 41x, the second-highest among the Magnificent 7, just behind Tesla (TSLA). However, Nvidia’s PEG ratio (P/E to growth) stands at 1.45x, making it one of the most reasonably valued tech growth stocks, second only to Alphabet (1.26x).

Despite its rapid rise, the nvidia stock price does not appear outrageously overvalued. With AI demand booming, Nvidia remains at the center of the semiconductor and AI ecosystem.

What Should Investors Watch for in the NVDA Premarket?

The nvda premarket is drawing significant attention. Investors are closely watching for updates from Huang’s China trip. Any positive news about renewed chip exports to China could drive the nvidia stock even higher before regular trading begins.

Key Takeaways:

-

The nvda stock continues to set new records, reaching a $4 trillion valuation.

-

The china nvda stock issue remains a potential growth driver or risk factor.

-

Analysts see the nvda stock price hitting $200 per share if China business resumes.

-

Watch the nvda premarket for early signs of market reactions to Nvidia’s China negotiations.